Fuel Market Report: July 14th – July 20th, 2024

Oregon Fuel Price Variance

Fuel Market News

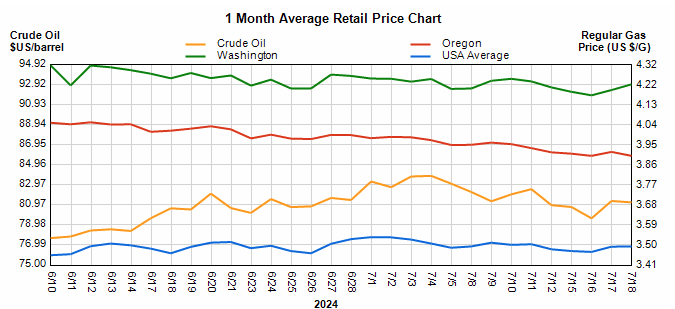

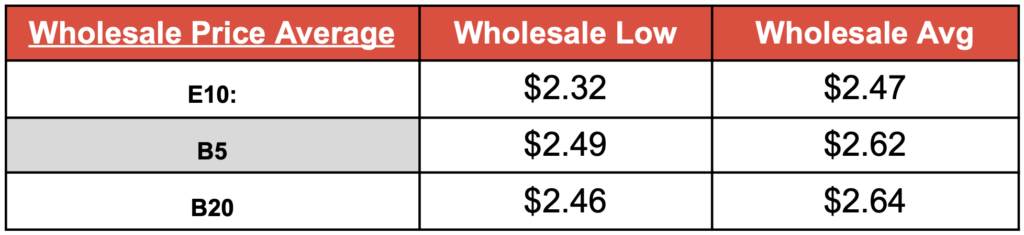

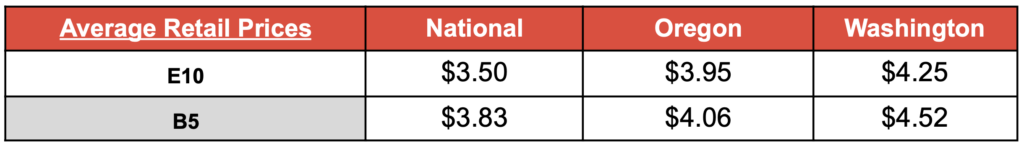

Fuel prices fell this past week across the board. Rack averages fell $0.13 for B5 and $0.16 while rack averages for E10 fell $0.04. Presses have continued to fall over the last 3 weeks. This is surprising as crude oil pieces have been relatively low, and fell to $76/barrel over the weekend. The lack of high summer fuel prices has been great for drivers and summer travelers but brings into question why demand is so low.

Curious to learn more about R80/B20 blends?

Book an appointment with one of our low-carbon fuel analysts.

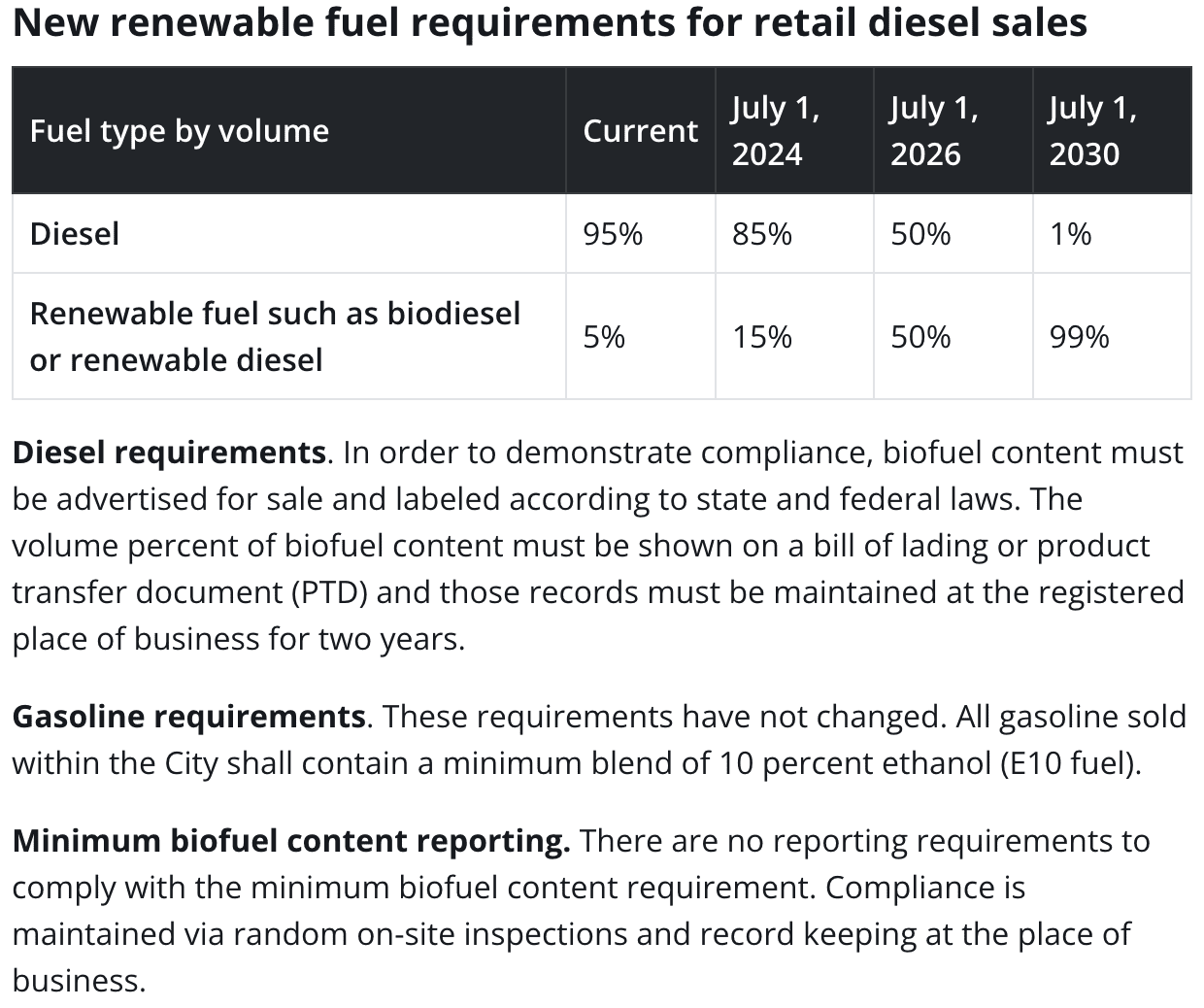

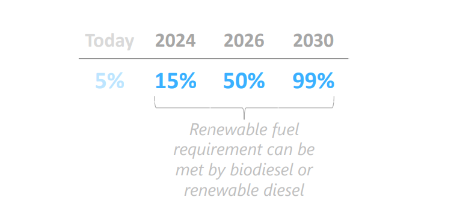

City of Portland began their fuel blending requirements for all diesel blends to increase to the minimum of a B15 blend. This will lead to most stations using B20 biodiesel or R99 Renewable diesel if allocations allow for it.

To learn more about these changes that will affect your company’s vehicles, equipment, and annual fuel purchasing schedule an appointment with one of our fuel market analysts.

Important Note: Per the City Of Portland, “Distributors in the City of Portland are required to meet the minimum biofuel content requirements for all fuel they distribute beginning on May 15, 2024. All diesel fuel distributed to retail stations, non-retail dealers, or wholesale purchaser-consumers must include a minimum of 15% biofuel content, from either renewable diesel or biodiesel. This requirement increases to 50% on May 15, 2026, and 99% on May 15, 2030”.

Reasons For Price Variance:

Crude oil is trading below $80 for the first time in nine weeks, at a current price of $76.81/barrel, $4.19 lower than last week, as oil prices trended downward, for the third time in 4 weeks. This is the biggest slump in 9 weeks as oil prices slipped over $4 this past week.

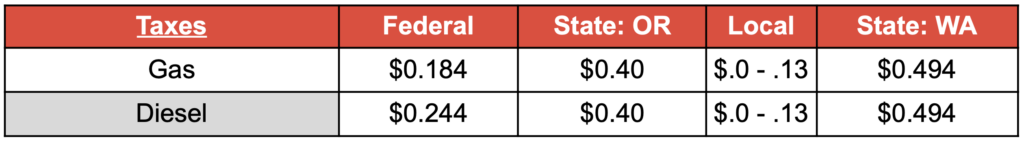

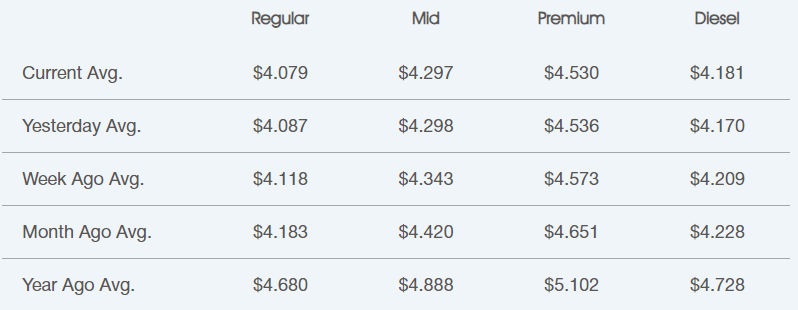

Crude oil is the main ingredient for gasoline and diesel. Per AAA, on average about 50% of what you pay at the pump is the price of crude oil, breaking down as 25% refining, 11% distribution & marketing, and 14% taxes—a helpful breakdown for consumers wondering why they are paying the prices that they pay. Crude Oil is trading at $76.81/barrel compared to $81.00/barrel, last week and $83 a year ago.

It’s essential to recognize that fuel prices result from a complex interplay of the factors mentioned above and other factors regionally. Additionally, prices may vary by specific regions within Oregon and Washington. For the most precise and up-to-date information on fuel prices and the causes for these price changes within your area, use the links below for AAA & GasBuddy.

If you have any questions, feel free to contact Star Oilco and speak to one of our fuel market advisors to discuss how the market can impact your business.