Oregon Diesel Taxes Explained

How Oregon Diesel Taxes Are Calculated

As of January 1st, 2022 Oregon is raising Fuel Taxes to $.38 a gallon. (source) The prices in this article have been updated to reflect that. There will be another $.02 a gallon fuel tax increase set in 2024 as well.

Oregon is unique in its handling of diesel. All fuel isn’t used or taxed the same in the state of Oregon. First off, there is no sales tax for any fuels. The taxes that are charged for diesel are divided into 3 categories: dyed diesel, PUC use and everyday road use or “auto diesel.” The big difference in pricing is how the diesel is used and the size of the vehicle using the diesel.

Oregon Fuel Taxes in a Nutshell

Off-road diesel

If a vehicle is burning diesel “off-road” like a back-hoe, agricultural use, generators or similar use, the fuel is not taxed by either the federal government or Oregon State. This fuel is also dyed red to show it is for off-road use only. If you use dyed red off-road diesel fuel in an on-road vehicle and you get caught, the state of Oregon can and will likely fine you $10,000. Yes, we have seen them do this in recent history.

On-road diesel (auto diesel)

If your vehicle is below 26,000 gross vehicle weight, Oregon charges a per gallon vehicle tax. This tax is paid at the gas pump, is collected by the retail or commercial cardlock location, and you do not have to consider any additional taxes other than buying on-road fuel.

On-road diesel (P.U.C. diesel)

If your vehicle is above 26,000 gross vehicle weight in Oregon, you pay a weight mile for your vehicle’s state diesel tax. This cost per mile depends on your registered vehicle weight with Oregon. It is anecdotally assumed at the top weights over 80,000 lbs of gross vehicle weight, this tax is equivalently more than double the per gallon cost of auto diesel bought at a retail location. This class of diesel usage requires extra P.U.C. filings and vehicles over 26,000 GVW have special P.U.C. plates denoting their class as it relates to diesel fuel tax.

Oregon Fuel Taxes for a Layperson

A small motorhome that would use on-road diesel

On-Road Diesel (Auto Diesel)

The easiest one to understand is on-road diesel, also known as “auto diesel.” Most non-truck vehicles driving on streets, roads, and highways around Oregon fall into this category for use, or as you can see in this picture, a smaller motor home or RV (recreational vehicle). This fuel is the one you see at a pump at a retail station. Its price includes federal tax, state tax and any applicable local taxes.

Current auto diesel taxes in Oregon for vehicles under 26,000 GVW (gross vehicle weight):

- Federal tax rate is $.244 per gallon

- The state tax rate is $.38 per gallon

In addition to these, local municipality and cities have their own taxes that can be added to the price of fuel. To make it even more complicated, some cities charge a different tax amount based on time of season; specifically Newport and Reedsport who charge a few more cents during the summer months. Currently the highest additional taxes are in the city of Portland, Oregon at $.10 per gallon. Source.

Example:

Fuel price at the pump is listed at: $2.989

- Federal =$.244

- State =$.38*

- Portland =$.10

For a total of =$.724 per gallon in taxes

The actual cost per gallon would be $2.265. This includes the OPIS (Oil Price Information Service) wholesale price, transportation costs, and the margin the retail station adds to pay its bills (usually $.15 to $.40 depending on the provider).

*January 1st, 2022 Oregon State Tax fuel went up to $.38 per gallon for Oregon Motor Vehicle Fuel Tax. Oregon Use Fuel Tax also went up to $.38 a gallon.

Dyed diesel, also called red diesel, is used for vehicles that don’t drive on public roads.

Off-Road Dyed Diesel

Dyed diesel, also called farm diesel, marked fuel, or red diesel, is a fuel that has an added dye in the mix. The dye, usually solvent red 26 or solvent red 164, doesn’t cause any change in the operation of an engine versus using regular clear diesel. The dye marks the taxable status of the fuel.

This fuel is intended for only off-road equipment and vehicles. Farm equipment, construction vehicles and any other vehicles that don’t drive on public roads can use this fuel. In addition, any engine or oil heater that burns diesel is allowed to use dyed diesel. Those that have heating oil delivered are purchasing dyed diesel.

The benefit of this fuel is that you save state, federal, and city or municipal taxes. Acquiring this fuel as a customer usually requires access to a commercial fueling station or hiring a fuel company to deliver the fuel. This is likely to prevent accidental use of this fuel in an on-road vehicle. Anyone found using dyed diesel in an on-road vehicle will be fined. Fines are either $10/gallon or $1000 per violation, whichever is greatest (Source). To ensure that diesel users aren’t abusing this fuel, police officers can “dip” a tank; usually by sticking a clear tube into a tank and verifying the color of the fuel.

Oregon PUC Permit and IFTA for vehicles over 26,000 GVW

Oregon PUC Permit

While PUC stands for “Oregon Public Utilities Commission”, it is the Oregon Transportation Department who regulates fuel taxes and PUC plates.

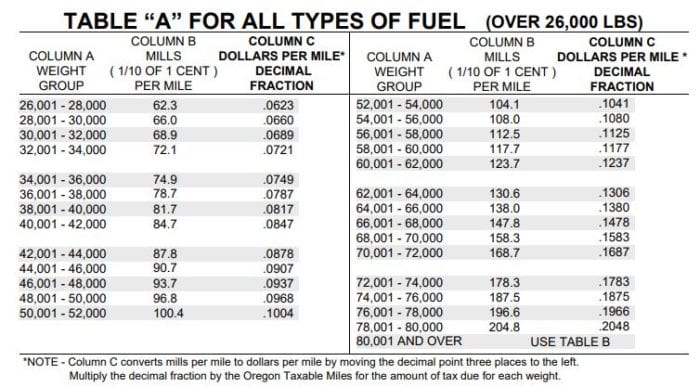

PUC plates are required by vehicles over 26,000 GVW. Oregon PUC Permit or heavy motor vehicle trip permit refer to vehicles that are at this weight and up to 80,000 GVW. They also include an Oregon PUC card number and a log book that shows fuel usage. View Table “A” tax rates.

These vehicles are only required to pay the federal tax at the pump. They are then required to log the mileage they drive and pay an amount based on weight, number of axles and miles. The heavier the vehicle, the more wear and tear on the road, so the higher the tax.

Source : Oregon Department of Transportation

The fees are applied for a whole trip. Say a truck is scheduled to drive 100 miles round trip to deliver watermelons. A vehicle driving 100 miles that weighs over 44,000 but less than 46,000 would be charged $0.0907 per mile or $9.07. Trucks that are driving a full load of product and an empty load back pay for the total miles of the trip, including the miles they are driving empty. In the above example, even if half the miles were at the 26,001 rate for the return trip, the taxable rate is the full load price.

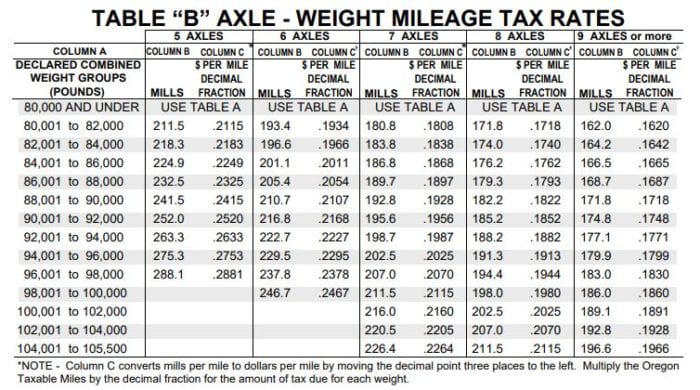

Any commercial vehicle that is over 80,000 GVW would use the Table “B”, which is similar but includes different pricing based on the number of axles, not just weight.

Source: Oregon Department of Transportation

As the vehicles get heavier, the amount of axles used change the price. In the chart, 5 axles at 81,000 miles is $0.2115 a mile and a vehicle with 9 axles and the same weight is $0.162 a mile.

For any additional questions about the PUC plates, tax rates and trucking information in Oregon, please contact ODOT at 503-378-5849.

IFTA – International Fuel Tax Agreement

IFTA is for the same vehicles over 26,000 GVW if they drive into more than one state or into Canada. This helps simplify the reporting process of taxes, refunds and mileage for vehicles that travel in more than one state. These commercial motor vehicles are required to file quarterly with their base jurisdiction and the amount of taxes that they might have paid at the pump is recorded. Then they either pay the difference or receive a refund if they overpaid. Prior to IFTA, trucks would need a permit for every state they operated in.

Star Oilco is a supplier of Fuel for NW Oregon and SW Washington. If you have questions about fueling your fleet or your construction site we would love to talk to you.

Contact Form

To learn more about What Oregon Requires for a Business to Use Pacific Pride and CFN Cardlock Stations

To learn more about RV Vehicles and Pacific Pride or CFN cards

Recent proposed legislation could mean more or different tax handling fees or laws in the future. We will be following these stories as they come out. If you would like to know more – Oregon Legislature proposes an end to petroleum diesel

If you would like to learn a little bit more about biofuels – Every Question We Have Been Asked About Biodiesel & Every Question We Have Been Asked About Renewable Diesel