What market forces are impacting the Oregon diesel outlook?

The US market is short diesel in storage while the Oregon market is short CO2 credits causing a unique market condition as we head into fall.

Diesel prices in the Pacific Northwest have not been following National trends for diesel. The west coast is paying a premium compared to other nearby states. Diesel in Oregon is significantly higher than the national average. More to the point, the carbon credits associated with biodiesel and renewable diesel in Oregon are trading at recent record high prices. Higher than California’s CO2 credit prices. What’s going on?

Well for once it isn’t the price of crude oil causing this, or the amount of biofuels. Its all about todays Oregon diesel and carbon markets. The story starts a few weeks before Memorial day.

Memorial day is often cited as the kick off to the driving season. It also is when we usually see construction and trucking pick up with the summer weather. A few weeks before Memorial day the Olympic pipeline went down unexpectedly. The Olympic pipeline serves Portland and Eugene with their diesel and gasoline fuels from the refineries in northwest Washington state.

That pipeline had an unexpected outage. Those happen for plenty of reasons usually safety checks or repairs. When the pipeline went down the market was notified it would probably be a week and open again the Monday before memorial day. That Monday, the Monday before one of the bigger fuel weekends of the year, came and notice went out the pipeline would still be down for another week.

At that moment supply was already short for gas and diesel. Especially diesel. The Portland and Eugene market saw diesel like a dollar cheaper in states like Idaho, Utah and others. So guess where diesel started flowing from? Markets responded as the bigger players on the ground in Oregon started moving diesel from those states. Your local truck stops, gas stations, and cardlocks didn’t run out of fuel in several parts of Oregon because of these efforts.

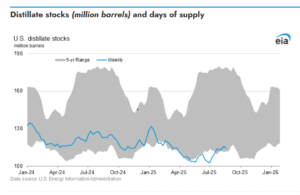

In a US diesel market that was already tight for diesel supply, Portland, Oregon had an event that made it even tighter demanding diesel from around the region. Markets responded sending higher price offers to bring diesel into Oregon. Source is US EIA.

Oregon does not have any petroleum refineries or even biofuel plants. It can only be supplied by pipeline, barge, rail or truck from outside the state. When the pipeline came back online quite a bit of outside diesel had flowed into the state from nontraditional sources by rail and truck.

The people who moved that diesel are regulated in Oregon with two programs for CO2 emissions. One is called the Clean Fuels Program which requires anyone importing diesel into Oregon to come up with a CO2 reductions by either blending low carbon biofuels or buying CO2 credits from others that use those fuels in the state. Oregon also has a Cap and Invest program which only allows so much fossil fuel to be sold inside Oregon in a calendar year. Oregon caps the total market for fossil fuels sold at retail stations as part of it’s carbon reducing strategy.

Guess what happens when a bunch of suppliers start bringing in gas and diesel to meet the market need? They have to come up with Carbon credits and allowances to meet those carbon reduction programs for liquid fuels. When unexpected volumes of diesel get imported into Oregon the CO2 market dynamics change.

For diesel, they need to start blending biofuels such as renewable diesel and biodiesel. So since that Memorial Day pipeline outage the people who imported diesel from other states need CO2 credits under Oregon Clean Fuels Program as well as to ensure they done sell to many additional gallons of fossil fuel diesel to exceed the allowance of Oregon’s cap and invest regime.

Therefore CO2 credits are high, people are trying to blend more biofuels to catch up to the unexpected volumes of diesel they moved into Oregon. Prices are higher than the rest of the US for diesel as a hangover to the supply disruption.

Upside for the first summer in a few years there is plenty of Renewable Diesel in the Portland, Oregon market as the CO2 credit prices are higher than California and the diesel prices are also high to help. In the last month we have seen a huge amount of Renewable Diesel show up into the terminals in Portland. So hopefully we will see lower prices heading into fall as all this works itself out. As we pass by Labor Day the market cost of diesel should normalize and return to a much more affordable price.

The one downside of high diesel prices is that it makes Renewable Diesel the same price as fossil diesel. If you want to try it, now is a good time where you can get it affordably and field test it for results with your fleet. Want to see how it performs in reducing truck regens, EGR services, and see if fuel economy improves with a cleaner burning synthetic diesel running in your fleet. This fall is a good time to experiment with it.

If you want to try Renewable Diesel in your fleet. Star Oilco has it immediately available. Please reach out to give it a try at either our Cardlock locations, with Mobile Onsite Refueling in your yard, or a Loaner Bulk Tank trial of the fuel in a few trucks.

Star Oilco has Renewable Diesel seven days a week for your fleet: Mobile Onsite Fueling, Cardlock, and Bulk Delivery.

Call us at 503-283-1256 or email at OrderDesk@StarOilco.net.