Oil Vs. Gas Heating; Which Is The Safest?

Heating

Automatic Keep Full Delivery

· On Approved Credit

· Budget Plan Available

· Optional Tank Contracts

· Optional Service Contracts

· Senior Citizen Discount Available

· Prompt Pay Discount Available

Will Call Delivery

· Cash/Check discounts available

· Payment Plan (on approved credit)

· Senior Citizen Discount Available

· Prompt Pay Discount Available

OIL VS. GAS – Which fuel is safer?

While a leak in your oil tank may cause temporary inconveniences, there have been no deaths or injuries associated with leaking oil tanks. The risks of injury are far greater with natural gas leaks and the statistics from the U.S. Department of Transportation’s Office of Pipeline Safety show that between 1986-1998, natural gas pipeline accidents have resulted in the deaths of over 200 people, injured more than 1,700 people, and caused more than $300 million in property damage. So safety is a legitimate concern.

Is natural gas cleaner and more efficient?

This is a misperception that is refuted by studies done by the U.S. Environmental Protection Agency, and the U.S. Dept. of Energy. According to these studies, heating oil and natural gas produce approximately the same levels of pollutants. Natural gas is not cleaner than heating oil. According to the U.S. Dept. of Energy and the Gas Appliances Manufactures Association, heating oil equipment is actually more efficient, on average, than natural gas heating equipment.

Is either natural gas or oil better for the environment?

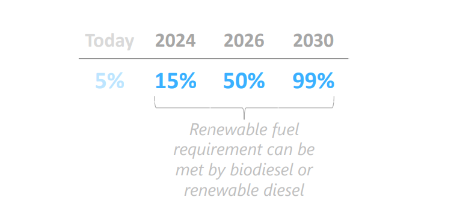

No. Both fuel sources cause similar amounts of pollutants in the environment. Many environmentalists are concerned about the risks to our wetlands, river and forests, that will be the impact of gas pipeline construction, and about leaks and accidents that have occurred in existing pipelines. Further, many have expressed concern about natural gas as it is a power greenhouse gas which contributes to global warming. If you are interested in heating with a fuel that is environmentally friendly, ask us about our biodiesel home heating oil.